Buying A Property While Abroad: Tips for International Investors

There are countless Filipinos across the globe in foreign countries. Overseas Filipino workers (OFWs), in particular, have become indispensable to the Philippines’ economic stability.

While OFWs have made a home abroad, purchasing property in the Philippines offers numerous benefits, including potential investment returns and the opportunity to own a home in their native country.

However, buying property abroad comes with unique challenges. Whether you’re looking to invest in a vacation home, generate rental income, or diversify your investment portfolio, careful planning and thorough research are essential.

7 Key Tips For Buying Property Abroad

There are several factors to consider in buying property overseas. Whether you’re buying property abroad as a home purchase, investment property, or to turn into short-term rentals the Philippines, we’ve got you covered.

We’ve listed practical and important tips for potential buyers looking to acquire property abroad:

1. Understand Local Laws and Regulations

One of the most critical steps when buying property abroad is understanding the local laws and regulations governing real estate transactions in the Philippines.

These foreign real estate laws may differ significantly from those in your current country of residence. It’s crucial to familiarize yourself with the legal aspects of property ownership, especially if you’re considering buying in markets where regulations might be less straightforward.

Hire a Local Attorney

Engage a local attorney who specializes in real estate and property transactions in the Philippines. A local lawyer can guide you through the purchasing process, ensure that all legal documents are in order, and help you avoid potential pitfalls, such as property ownership disputes or local regulations that you might not be aware of.

When you buy property overseas, it’s imperative that you have top-notch legal counsel and representation on the ground.

2. Work with A Reputable Real Estate Agent

When buying property overseas, especially in a foreign country like the Philippines, it’s essential to work with experienced and reputable real estate agents.

A knowledgeable real estate agent can provide valuable insights into international property values, help you identify the best investment opportunities, bridge the gap between any language barrier, and navigate the complexities of real estate overseas.

Seek Expert Advice

Look for agents with a strong track record and positive reviews from other foreign buyers.

They should be able to offer expert advice on investment property options and similar properties, guide you through foreign purchase procedures, provide you with mortgage options, assist with local culture and norms, and help you overcome language barriers that may arise during the transaction.

3. Consider Financing Options

Securing financing is a crucial part of any real estate investment. As a foreign investor, you’ll need to explore your financing options carefully. Some local banks in the Philippines offer mortgage products specifically designed for foreign buyers and Filipinos living abroad in many countries.

International Bank Account

Setting up an international bank account can be beneficial, especially when dealing with currency exchange and transferring funds for your property purchase.

Additionally, consider working with international lenders that offer international loans tailored to overseas property purchases.

An international account will come in handy when you finally buy property abroad. It will allow you to make overseas property purchase transactions, collect rental income, and settle any tax issues that may arise later on.

Lending Criteria and Interest Rates

It’s important to understand the lending criteria and interest rates associated with financing your property overseas.

Interest rates and terms can vary widely, so compare offers from different banks to find the most favorable financing option for your situation.

It’s also a good idea for international real estate investors to speak to different financial institutions to discover the best financing options and payment terms to best suit their needs.

4. Manage Currency Exchange and Foreign Currency Risks

Buying property abroad involves dealing with different currencies, which introduces currency risks. When the exchange rate fluctuates, it impacts the final cost of foreign real estate.

It’s vital that you keep track of these fluctuations when you invest in real estate overseas.

Monitor Exchange Rates

To minimize risk, monitor exchange rates closely and consider locking in a rate when it’s favorable. This can be done through your bank or a specialized currency exchange service.

Foreign currency fluctuations can have a significant impact on your international real estate investment, so it’s wise to plan for these changes in your financial planning.

International Account for Currency Exchange Rates

Having an international finance account can also make managing currency exchange easier, as it allows you to hold funds in multiple currencies and transfer them as needed.

5. Evaluate the Economic and Political Stability of the Area

When making an international real estate investment, you don’t only consider the local culture, you should also consider the political climate.

Before finalizing a property purchase in the Philippines, assess the economic stability and political risk of the area where you plan to invest.

Properties in areas with stable economies and favorable political climates tend to appreciate over time, providing better returns on your real estate investment.

Research Emerging Markets

Buying property abroad in these markets may be appealing. While they offer lower prices and higher growth potential, they can also come with greater risks.

Conduct thorough research on the local economy, government stability, and any potential political risks that could affect your investment property abroad.

6. Consider the Tax Implications

Understanding the tax implications of owning property abroad is essential for any international investor. In the Philippines, property owners are subject to various taxes, including property taxes, capital gains taxes, and other fees associated with property ownership.

If you lease out your international property, you may also need to pay taxes on your rental income.

To navigate the complexities of taxation in a foreign country, consult a tax professional who is familiar with both Philippine and international tax laws.

They can help you plan for property taxes, understand how capital gains taxes might affect your investment, and ensure compliance with all relevant tax regulations.

Proper financial planning can help you optimize your investment by minimizing tax liabilities.

This might include structuring your foreign property purchase in a tax-efficient manner or taking advantage of any tax treaties between the Philippines and your home country.

7. Stay Informed and Regularly Visit the Property

Even though you’re buying property overseas, it’s crucial to stay informed about the local real estate market and regularly visit the property if possible.

This will help you monitor the property’s condition, assess the local market trends, and ensure that your investment is being managed effectively.

If frequent visits aren’t feasible, consider leveraging technology for remote property management. Many real estate agents and property management companies offer online services that allow you to monitor your property, manage tenants, and oversee maintenance from afar.

Engage with expat communities and other foreign buyers in the Philippines. These networks can provide valuable insights, share experiences, and offer support as you navigate the challenges of owning property overseas.

Your Best Investment Property Awaits in Camella

Buying a property abroad can be a rewarding investment, offering both financial returns and a tangible connection to your home country.

However, it requires careful planning, thorough research, and a deep understanding of the local market and legal landscape.

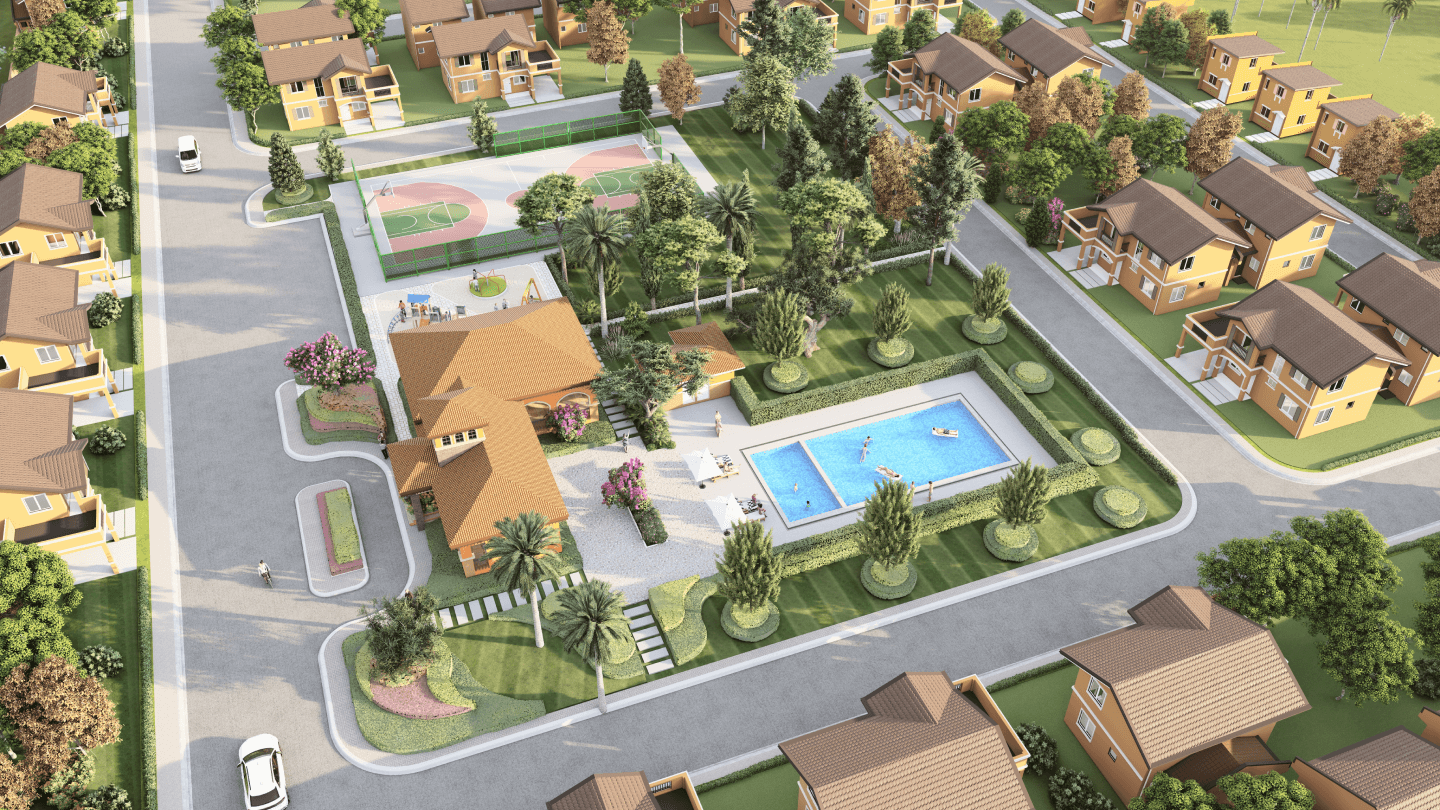

If you’re looking to buy property abroad, there is no better developer to invest with than Camella. We create homes for Filipinos up to par with international real estate standards.

Our developments have world-class amenities including community spaces, fitness centers, and expansive roads and sidewalks. A home in Camella is an ideal choice for investors abroad looking to buy international property.

With Camella, you’ll have all the support you need. By following these tips on buying a property overseas, you can make informed decisions and successfully manage your property purchases.

Whether you’re expanding your investment portfolio or planning for a future home in the Philippines, the right approach will help you achieve your real estate goals.