Technological advancements grew exponentially in recent years and transformed the digital world. This is most evident in the trade within the internet realm. Here, people use cryptocurrency as the equivalent of money in purchasing and exchanging things, files, and other resources. With the rise of Bitcoin, digital wallets, and virtual currency, people are now looking into the usefulness of non-fungible tokens (or NFTs)—which is now a growing digital asset.

From photos, music, memes, and even lands, NFTs have been steadily rising as a source of profit. They can even buy real-life necessities and wants and even invest in real estate properties up for sale. One might still ask—are NFTs just fads and trends, or are they profitable in the long run? Do not worry, as we will discuss the value of NFTs in detail.

What are NFTs?

Fungibility

To understand NFTs, we must first need to understand what fungibility means. Under the study of economics, fungible tokens are assets that can be exchanged on a one-for-one basis. Fungibility is best shown in currencies we use, like one British pound can be exchanged to nearly Php 67. Another example is business transactions, like purchasing a house and lot for sale in the Philippines for P10 million. Even though they are now different in form, currencies have their own value and can be freely traded.

Non-Fungibility

In contrast, NFTs, or non-fungible tokens, refer to cryptographic “tokens,” which are non-interchangeable units of data. These are strings of unique codes stored on a digital ledger similar to a Bitcoin. NFTs cannot be simply substituted for something similar.

Take the original file for Bliss, for example. Bliss is Microsoft XP’s default wallpaper featuring a green hill and blue sky with clouds. It cannot be exchanged with a similar digital poster from Google because they do not hold the same value. NFTs are one-of-a-kind which varies among each item.

They can be represented as unique digital assets, which provide its owner a digital certificate of authenticity. This, in turn, can be put to various items such as artworks, audio files, video clips, even memes, and other collectibles, as long as they are digital. Because NFTs are irreplaceable original items in the digital world, that makes them much more valuable.

The Rise of Non-Fungible Tokens

Before NFTs came about, it was almost impossible to authenticate and “own” digital art or music. It used to be that people can easily take a screenshot or simply download a file to signify ownership. NFT solves that problem since it provides a unique set of data stored in a blockchain. That said, NFTs operate like an autographed items or unforgeable signatures. With this, owners of digital content can now prove legitimate and original ownership. More than proofs of ownership, the buyers and new owners can exercise their bragging rights of owning an authentic version of an art piece.

Although NFTs may only function like digital certificates of authenticity, they also serve as a medium for a more lucrative and realistic investment. Through NFTs, early creators, accidental internet stars, influencers, and even up-and-coming artists on the internet are now secured. They now have the power to make their creations scarce and therefore more valuable.

How NFTs gained Popularity

NFTs are not entirely new, but their rise to popularity has been a product of early movement, mainstream awareness, and buying frenzy.

Colored Coins

Colored Coins are said to be the earliest predecessor of NFTs, which date back to March 2012. They are very small units of Bitcoin with extra functionality that allowed them to represent other assets on the blockchain. As its name suggests, they have various colors with specific attributes coded into the metadata using the language of Bitcoin. Although they showed promise and potential, Colored Coins had to face particular challenges. These include the lack of support from the Bitcoin network, complex implementation and development, and pressure to maintain its regulation value.

Ethereum

Around 2017, the cryptocurrency had its notable boom period wherein Bitcoin-based token platforms started to gain prominence, especially Ethereum. Thanks to its smart contract layer, Ethereum’s system for token creation and storage removed third-party platforms. As a result, it leverages more capabilities to expand to the digital market.

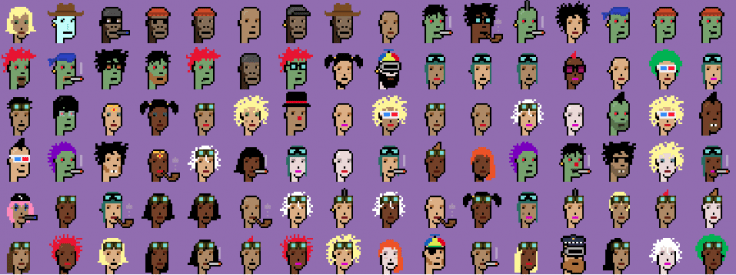

CryptoPunks

2017 also saw the rise to the success of CryptoPunks, where the Ethereum blockchain generated 10,000 characters with unique appearances in its algorithm. These 24×24 pixel characters have different types, attributes, and rarities, where certain combinations can lead to tremendously valuable Punks. For example, the most expensive Punk was an Ape Punk with a Hoodie, which sold for 150 ETH, equal to $71,000 US.

Now, Punk ownership is treated as a badge of honor and status symbol. This identifies the owner as one of the original movers in the crypto world. Some traders look for Punks as a part of their collection. In fact, reports as of October 2020 show that CryptoPunks sell for as much as $5,000 US per transaction.

CryptoKitties

In the same year, CryptoKitties was also launched by Canadian studio Dapper Labs on Ethereum. It was a virtual game that allowed players to breed, raise, and trade digitally created cartoon cats with unique genomes that influence their appearances. This game ushered the wave of crypto-collectible, and it also pioneered blockchain technology intended for leisure and entertainment.

One creative aspect in CryptoKitties is its ability to breed to produce offspring with different cattributes (cat attributes), including eye shape, base color, fur, mouth shape, and pattern, among others. Even though the activity in CryptoKitties has dwindled, it still remains valuable, like Dragon, a ninth-generation digital cat with a cotton candy color which sold for 600 Ethereum, or US$172,000 at that time.

Various Uses of NFTs

From simple illustrations up to house and lots for sale, the interest for NFTs has significantly increased because they can be used to represent any asset, whether digital or actual. Enthusiasts, developers, and collectors frequently purchase art, music, sports, gaming, and other forms of popular entertainment. Nonetheless, the use of NFTs is a work-in-progress for different fields like fashion, university research, and even the purchase of real-life assets such as the sale of properties and investments, whether beyond or within metropolitan areas.

With the widespread popularity of CryptoKitties and CryptoPunks, the interest in collecting digital collectibles also entered the mainstream media.

NFTs in Sports

Dapper Labs, the developer of CryptoKitties, became the developer of NBA Top Shot. They include digital basketball cards that feature iconic moments and game highlight videos of basketball players sold up to six figures. Recently, a video clip of NBA star LeBron James dunking could have been just easily watched online, yet it sold for US $200,000.

Other athletes also acquired an interest in NFTs, like NFL quarterback Tom Brady who is about to launch a company called Autograph to produce NFTs. With NFTs in mind, even traditional collectors like the Topps Company now seek an alternative route to widen their investment possibilities. It is a significant move for Topps, being the leading producer of baseball, American football, and other sports-themed trading card items.

NFTs in Gaming

The entertainment and gaming industry are also benefactors of the rise of the NFTs. To further improve fun and interactivity, NFTs are now used to represent in-game assets controlled by the user instead of the game developer. Turn-based battle or trading card games such as Gods Unchained and Axie Infinity have gained active token holders and marketplace participants. This makes them two of the top games of the blockchain gaming community.

The future is bright for video gamers, as NFTs in video games venture into ‘play-to-earn’ as a new business model. Here, players are allowed to monetize their time, as well as collect and sell in-game items. This improves the game’s properties over time through continued use and even creates rare collectible items with unique appearances. These unique in-game items can create a more individual gaming experience and increase the quality of video games.

NFTs in Music and Art

Moreover, the music and art industries both took a significant upswing when the NFTs were introduced. NFTs have allowed artists to monetize their artwork and protect their copyright. For example, Kings of Leon became the first major rock band to release their special-edition album. Entitled ‘When You See Yourself,’ the digital album was sold with uniquely numbered NFTs. It generated $2 million in sales, with a quarter of its proceeds donated to live entertainment workers.

NFTs also allow artists to receive royalties every time their creations are sold. Such was the case of Mike Winkelmann, a digital artist popularly known as Beeple. He made a collage of 5000 digital images, titled Everyday: the First 5000 Days, which sold for $69.3 million at Christie’s auction house in 2021.

The NFT mania also pushed Rarible Inc., a Delaware corporation, to develop its yield-farming incentive program. This, in turn, led to the creation of its art marketplace using NFTs as modes of exchange, with features like live auctions, hot bids, hot collections, and explorations.

NFTs in Virtual Reality

One of the significant advancements of NFTs is its success involving lands. On a new twist, it boosted the desirability for virtual worlds. Here, dedicated gamers and investors garnered millions of dollars on buildings, lush fields, and rolling hills that only exist within video games. Decentraland is the most developed and fastest-growing virtual land investment in the market at present. It takes pride in itself as the first-ever virtual world owned by its users. Now, the company owns parcels of digital land that sell at an average price of $1,653.64.

Likewise, the video game Minecraft has also ventured into crypto. It is the most popular game today that allows players a large amount of freedom in choosing how to play it. With Minecraft, players can earn in-game tokens by killing monsters and getting land in the form of NFTs.

NFTs in Real Estate

Furthermore, among the original purposes of NFTs is to tokenize real-world assets that can then be traded later on. The purchase and sale of real property were initiated by OpenLaw, a legal operating system for blockchain technology, which has procured a system involving Ethereum.

Propy, a real estate transaction platform, recently gained traction for auctioning the world’s first real estate NFT with ownership transfer. It featured an apartment in Kiev by TechCrunch founder Michael Arrington as the property being referred.

Although NFTs are still in the infancy stage in real estate industries, there is a high potential of NFTS in this field. Be it maintenance, payments, or collecting rents from the land, housing, or commercial properties, investors foresee a considerable investment opportunity when NFTs make a breakthrough in this industry.

Criticism on NFTs

With the world coping with the complexities of the digital era, non-fungible tokens are very powerful and hold immense capabilities for their future application. NFTs greatly appeal to everyone’s innate human desire to own rare and unique items. They also have significant upside potential while emphasizing permanence, authentication, and market value of whatever asset they represent.

However, the adoption of NFTs is still low relative to the tens of millions of cryptocurrency owners globally. Like other new entrants to the digital field, NFTs remain as novel technology. Having been created in their current form for less than a decade, NFTs raises the question of safety, authenticity, and valuation.

Security Concerns

While there is growth in the marketplace of NFTs, skeptics say that there is still the risk of grifting, art theft, and difficulty in its real-world linkage. Since NFTs exist in the online realm, they possess the potential to be hacked, which may lead to privacy concerns and consumer protection problems.

Environmental Concerns

In addition, NFT purchases and sales are tied with the environmental concerns surrounding blockchain transactions, such as high electrical energy use and greenhouse gas emissions. Since NFTs involve various processes such as minting, bidding, selling, and transferring, these processes contribute to high energy costs, increasing the carbon footprint of crypto-art.

Unregulated Currency

Regulation is also one problem linked to NFTs. The major challenge for NFTs and other cryptocurrencies is that they are not considered legal tender in various countries. Plus, they are not supported by any central issuing authority or inherently valuable asset. They also run the risk of being considered as securities and catching the attention of regulators.

Data scientists, investors, and researchers predict that NFTs are here to stay and are expected to be valuable in the long run. Suppose you are interested in taking a dive into the crypto world. In that case, you should be secured on what particular field you will be venturing into. Whether art, entertainment, or music in digital form, or even purchasing collectibles, lands, or house and lots for sale, enthusiasts should take extra steps when entering into the world of NFTs.

Once your experience in NFT has been successful, it is recommended to utilize these rewards and earnings in other non-digital money-makers. These are traditional investments such as stocks, bonds, or insurance. However, one of the most rewarding investments is in real property. If you want to invest in a real estate property, make an inquiry or schedule an appointment with Camella now.