Like what Agatha Christie once said, “The first time you do a thing is always exciting.” And I bet we can all agree on that. Similar to marriage and getting your first car, buying your own home is one of the most exciting and most significant decisions you have to make. In fact, it could be the biggest purchase anyone can make in their lifetime.

Many factors need to be considered, especially for first-time homebuyers. Apart from the cost and the need for it, there are other things that you should take note of.

Related: 10 Questions Every Homebuyer Should Ask Their Real Estate Agent

But worry no more, we’ve got some helpful tips listed here that would help our first-time homebuyers have an easier life before, during, and after their house and lot purchase.

Are you ready to commit?

Before anything else, your willingness and readiness should be your top priority when it comes to buying your first home. Do you think that this is the right time to purchase the property?

Take note that that home marks the beginning of a new chapter in your life, so you better make sure you are a hundred percent ready. Once you start the home buying process, you’ll be facing a big responsibility and, of course, spending a lot of money, time, effort. You have to be emotionally and financially ready to commit to purchasing your home.

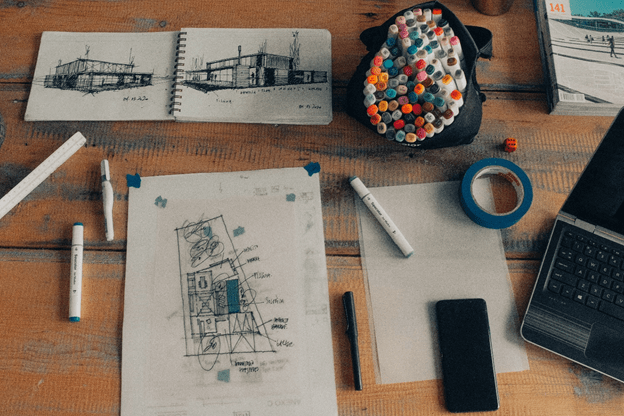

Decide on your dream home

If you have already decided on buying your first home, it’s time for you to decide what type of house and lot you want. What are the features you are looking for in a home? Do you like a bungalow type of home? Or do you prefer a two-story house and lot? How many bedrooms would you want your home to have? Is a balcony part of your dream home? If you have a car, you might want to have a carport. Maybe you want all of these features in your house. Remember that each feature has its cost, so you must factor in each one of them and decide wisely.

Look for the right real estate developer

After finalizing what type of house and lot is right for you, choosing the perfect community should be next on your list. Your needs and lifestyle will determine your ideal neighborhood.

So if you are someone who prefers a home near transportation hubs and commercial establishments, or is situated near access roads, then you might want to live in a master-planned community where all of these are close to you.

Know your budget

Once you’ve finally decided on where to buy your property, you need to check your budget. Do you have enough savings to cover the cost of the home purchase? If yes, then you are lucky.

When purchasing a property, many types of expenses are required, such as the reservation fee, down payment, amortization, and move-in expenses where the home repairs, upgrades, and furnishings are included.

Aside from those mentioned, you also have to spend money on your appliances and furniture to fill in your home. The best way to save money for your home is to list down the important ones first. Other home improvements and add-ons can wait in the long run.

Consult a real estate professional

If you want a hassle-free home buying process, consulting with a real estate professional is a good decision. These professionals are experts when it comes to the home buying process that can help you throughout.

Aside from the assistance of preparing your documents and loan approvals, they can also recommend properties fit for your budget and needs. They can also help you negotiate with the seller. You have to look for someone reliable and qualified to do the job. As the saying goes, “Ask the experts.”

Learn the home buying process

Even if you consulted and hired a real estate professional, it is better to know the workaround of the home buying process. It would be best if you did not depend on them all the time.

Since this will be your home, you should have an idea of how things work. If you have friends or family members who were first-time home buyers, ask for tips from them. If you have no time to ask them, you may read property developers’ guides on how to go about your purchasing.

Consider other financing options

Do you have a limited budget? Don’t worry because there are other ways you can achieve your dream home, such as applying for a loan. Some developers offer different financing schemes depending on your budget. You may opt to go for bank financing, which offers lower interest.

Related: 6 Banks To Help Finance Your Dream House And Lot

If you want your home to be ready in no time, you can go for a spot cash financing scheme. If your developer is offering Pagibig Financing, you may also take advantage of that one because of the fixing period of up to 30 years.

Another tip when choosing your financing option is to get a pre-qualification and pre-approval letter.

What is pre-qualification?

Pre-qualification determines the estimated loanable amount you can get based on your income statement and other financial information.

What is pre-approval?

Preapproval, on the other hand, is the document that states the loan money you can get. With the help of these two, you can quickly know what you can afford and what your limit is.

Homeownership is truly a rewarding experience for any individual. Aside from the fact that you get that peace and privacy, homeownership is a good investment option that many people nowadays are eyeing to invest in.

Now, if you are a first-time homebuyer looking for the ideal community to purchase your property, Camella is one of the best options to choose from. With a presence in 48 provinces and 149 municipalities across the country, Camella is a pioneer in homebuilding and is the country’s most-preferred real estate brand.

Aside from its convenience and accessibility, each Camella Community is designed to meet every Filipino family’s needs, wants and lifestyle. You’ll never go wrong investing and purchasing a Camella property because it is a lifetime investment you and your future generation can cherish over time.

Have you decided on when to purchase your first ever property? Browse our catalog of house and lot for sale in the Philippines or check our list of house models.